One of the most trusted sources of business information, our Business Information Report (BIR) helps you determine a company's profitability, financial stability, and payment performance. It's an industry standard for evaluating both new and existing credit relationships, especially medium-to-high risk accounts. Plus, it supports your company's other efforts, like marketing and purchasing.

The BIR provides an overall profile of a company, including financial information, payment history, trends, history of business, ownership details, operational information, and details on related firms and special events. It is available on millions of establishments worldwide.

How Do You Use It?

How Do You Use It?

D&B Business Information Reports help you take day-to-day credit decisions, analyse a company's financial strength and discover commercial opportunities.

- Assess the health and future viability of a company with the D&B Rating

- Access PAYDEX® to easily understand past payment behavior and financial stability

- Verify that a business exists and check its size and purpose

- Review the background of owners and key employees

- Identify company payment patterns and financial trends

- Includes legal information to detect possible fraud

Get your Business Information Report

Get your Business Information Report

A one-time detailed credit report on another company can help you:

Avoid payment defaults by assessing a company’s payment history before doing business

Assess a company’s credit with straightforward risk indicators and explanations

Will you get your payment / supplies on time

Determine the amount of credit to extend to partners and vendors

Mitigate potential business risks by accessing a company’s bankruptcies and liens

What’s included?

What’s included?

D&B Business Information Reports contain up to date information, collected from various data sources, and a translation into a clear risk assessment. Listed below are the important elements in the reports.

Business Summary

Factual information on the existence, operations, financial condition, management experience, line of business, facilities and locations of the subject firm.

History, Special Events & Operations Data

Incorporation details, par value of shares and ownership information. Related companies, including identification of parent, affiliates, subsidiaries and/or branches worldwide. Special events, as well as any suits, liens, judgments or previous/pending bankruptcies.

D&B Rating

Gives you a quick assessment of a firm’s size and composite credit appraisal, based on the company’s financial statements and an overall evaluation of the firm’s creditworthiness.

D&B PAYDEX Score

An objective assessment of the speed at which a company pays their invoices, based on actual payment experiences of several companies, reported to Dun & Bradstreet by trade references.

Corporate Family Tree

Insight into the national and international family relations. Information about national and world wide, all subsidiaries, branches and letters of reliability. Parent company, affiliated concerns, subsidiaries, branches and divisions, referenced with name and D&B D-U-N-S® Number.

Payment History and Payment Terms

Through the cooperation with several collection companies, Dun & Bradstreet has a large number of negative payment experiences that are important in determining the risk of failure.

Data on Directors

The reports contain information on the current and previous management. Background information on management, such as the educational and career history of the company principals.

D&B Credit Limit Recommendations

The Recommended Credit Limit shows the total value of goods and/or services the `average´creditor should have outstanding at any one time.

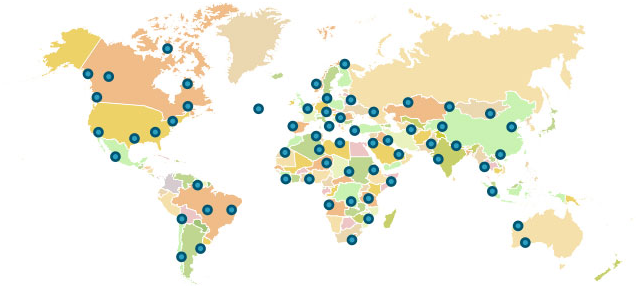

Local & International

Local & International

Besides information on regional companies you have access to the international database of D&B with more than 280 million records. Thanks to the international network you get the best quality based on local availability. Check our World Wide Network